Inflation, Rising Interest Rates, a Recession, and Bank Failures – Connecting the Dots

By Robert A. Bent CFP

This past June the Wall Street Journal reposted that Federal Reserve Chairman Jerome Powell said, “the central bank’s battle against inflation could lead it to raise interest rates high enough to cause a recession, offering his most explicit warning this year.”

Inflation is one of the most important economic indicators because it drives up prices, which in turn affects spending and investment decisions. When inflation is on the rise, it often signals that the economy is growing and that interest rates will soon follow suit. A recession is typically defined as two consecutive quarters of negative economic growth. In the United States, a recession is also accompanied by a rise in the unemployment rate. Bank failures can occur during periods of economic hardship, such as a recession. When banks fail, it can lead to a loss of confidence in the financial system and a decrease in the availability of credit. Inflation, rising interest rates, and recessionary conditions can all lead to bank failures.

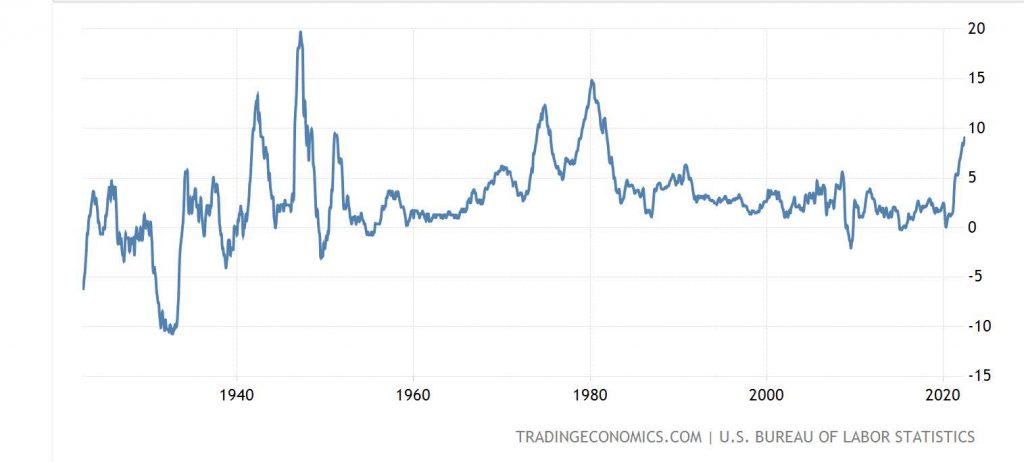

The reported inflation rate in June 2022 was 9.1%, the highest in 40 years.

When these economic indicators are on the rise, it is vital to monitor the health of your bank and make sure that your deposits are insured.

During a recession bank failures are more common.

During a recession, banks are more likely to fail. There are several reasons for this. First, there’s a lack of demand for loans and deposits in the economy; therefore, it becomes more difficult for banks to generate revenue from their operations. Second, during a recession many people default on their debts because they cannot afford them anymore or because they don’t believe that they can pay back their loans or bills anymore (this is called “the credit crunch”). Thirdly, when there is an economic downturn investors will withdraw funds from stock markets which makes them less liquid than usual, making it harder for these companies’ share prices to rise beyond the levels where they were before this happened.

Banks with low capital-to-asset ratios are more likely to fail.

The Federal Deposit Insurance Corporation (FDIC) has a database of all insured banks in the United States. According to this database, banks that have low capital-to-asset ratios—which is an indicator of how much equity each bank has relative to its debt—are more likely to fail during economic recessions than those with high capital-to-asset ratios.

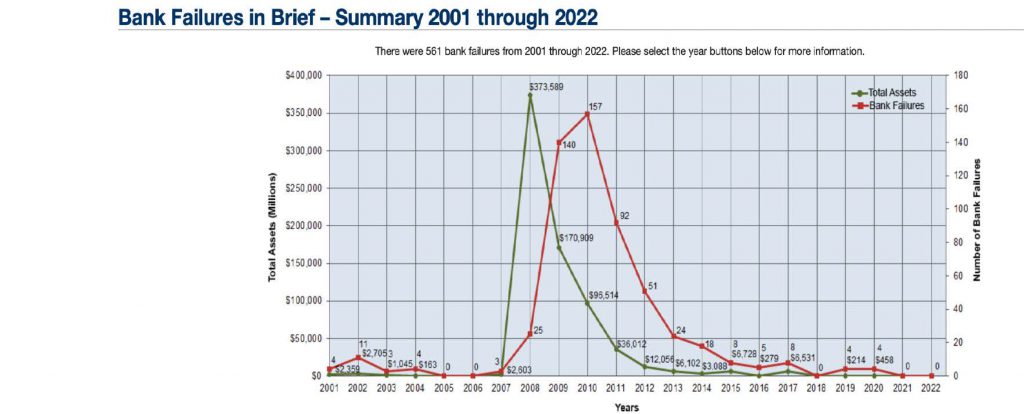

Bank failures occurred during the recession of the early 1980s and the Great Recession of 2008.

The recession of the early 1980s was a significant economic downturn that began in late 1981 and lasted until 1982. The United States was hit particularly hard by this recession, which resulted in hundreds of thousands of job losses and lower wages for many Americans. The Great Recession was the worst economic downturn since World War II, when unemployment reached 10%.

Source: FDIC.GOV

If you want your money to be safe, consider where you put it in a recession.

The best way to protect your money during a recession is to make sure you have an insured deposit account. Most banks offer FDIC insurance on deposits up to $250,000 ($500,000 for a joint account). However, it is essential to note that balances above this amount are not insured.

What can I do to protect our cash?

If you are looking for a place to put your money during a recession, consider FDIC-insured banks. The FDIC was created in 1933 as part of the New Deal and has been protecting consumers since then. Their role is to make sure that depositors have their money if a bank fails so they can get back on their feet quickly.

- The FDIC guarantees deposits up to $250,000 per individual and $500,000 per joint account holder with any one institution.

- For balances above $250,000, you can allocate your funds with an institution that offers insured deposit accounts. Insured deposit accounts take advantage of the FDIC pass-through insurance coverage provisions and allocate your funds to the banks within their network of well-capitalized banks in increments not exceeding $250,000 for each bank. In addition, most insured deposit accounts offer daily liquidity, like a regular bank account, and many pay higher interest rates than most commercial banks.

About the author:

Robert Bent is Senior Vice President of Landing Rock Cash Management. His expertise and abilities are reflected in his successful corporate and entrepreneurial track record. It includes high-profile leadership positions and innovative achievements in governmental organizations, multinational corporations, and his business ventures. Organizations included the United States Federal Reserve System, Viacom/CBS, Tyco International, and BAE Systems. Mr. Bent was also the founder and President of Global Fiduciary Advisors, a registered investment advisor that provided investment and fiduciary education services, and also served as a member of several investment committees which collectively provided oversight to over $16 billion in qualified plan investments. As a result of his experience, he is recognized as an expert on retirement issues and published several articles on fiduciary and investment-related topics.